Georgian-style homes were one of the most common styles in the 18th century and showcased formal and classical details that previous homes didn’t. Georgian houses are similar to Federal houses, though they can be distinguished by:

- A crown and pilasters framing the front door

- Decorative quoins or bricks at the corners

- Smooth decorative blocks as moulding

You can also find regional variations with hooded front doors and pent roofs between levels.

Ranch house styles are the most searched style in the US today and are common in cities and suburbs across the country. There are various ranch house styles, including California and split-level ranch homes. The main distinguishing features between these styles are living space and home layout.

Ranch style homes feature:

- Single-story floor plans with low-pitched roofs

- Rectangular, “U,” or “L” shaped open floor plans

- Patio or deck space connected to the home

- Often includes a finished basement or attached garage

Ranch homes are the most popular homes in 34 US states — particularly in the Midwest and on the East Coast.

A college endowment refers to all the money that an institution receives in donations. However, endowment funds are not ‘no-questions-asked’ cash boosts for the college. Instead, endowments are tightly controlled investments that are supposed to be grown so that the interest can be used to upgrade facilities, hire new staff, provide scholarships or aid the college or its students in some way.

Over the past three decades, the total market value of the 20 largest college endowments has grown nearly tenfold — from $30.6 billion to $302.1 billion. As the size of college endowments has increased, so too has the debate over their purpose, management and ethical obligations.

To get a better idea of how college endowments have changed over the last 30 years, DegreeQuery looked at the market value of the 20 largest U.S. college endowments from 1990 to 2020.

30 Years of U.S. college endowments

Based on the most recent NACUBO survey of 810 universities, the total market value of endowments in 2018 was $624.3 billion. 48.3% of that is held by just 20 colleges. But why the huge growth in market value over the past 30 years? It might be something to do with how much of the endowment the university chooses to spend on operations or the return rates of the endowment’s investment portfolio. Due to their often wealthy donor base and long-term investment horizons, the largest university endowments can invest in a diverse array of asset classes, and often grow faster than the economy as a whole.

From 1990 to 2020, the market value of the 20 largest college endowments grew at an average annual rate of 8.5% — faster than the 6.6% average annual growth rate for the Fortune 500 over the same period. The universities with the fastest growth over the past 30 years include the University of Michigan, Duke University and the University of Notre Dame. Meanwhile, the endowments with the slowest growth include Emory University, Rice University and Washington University in St. Louis.

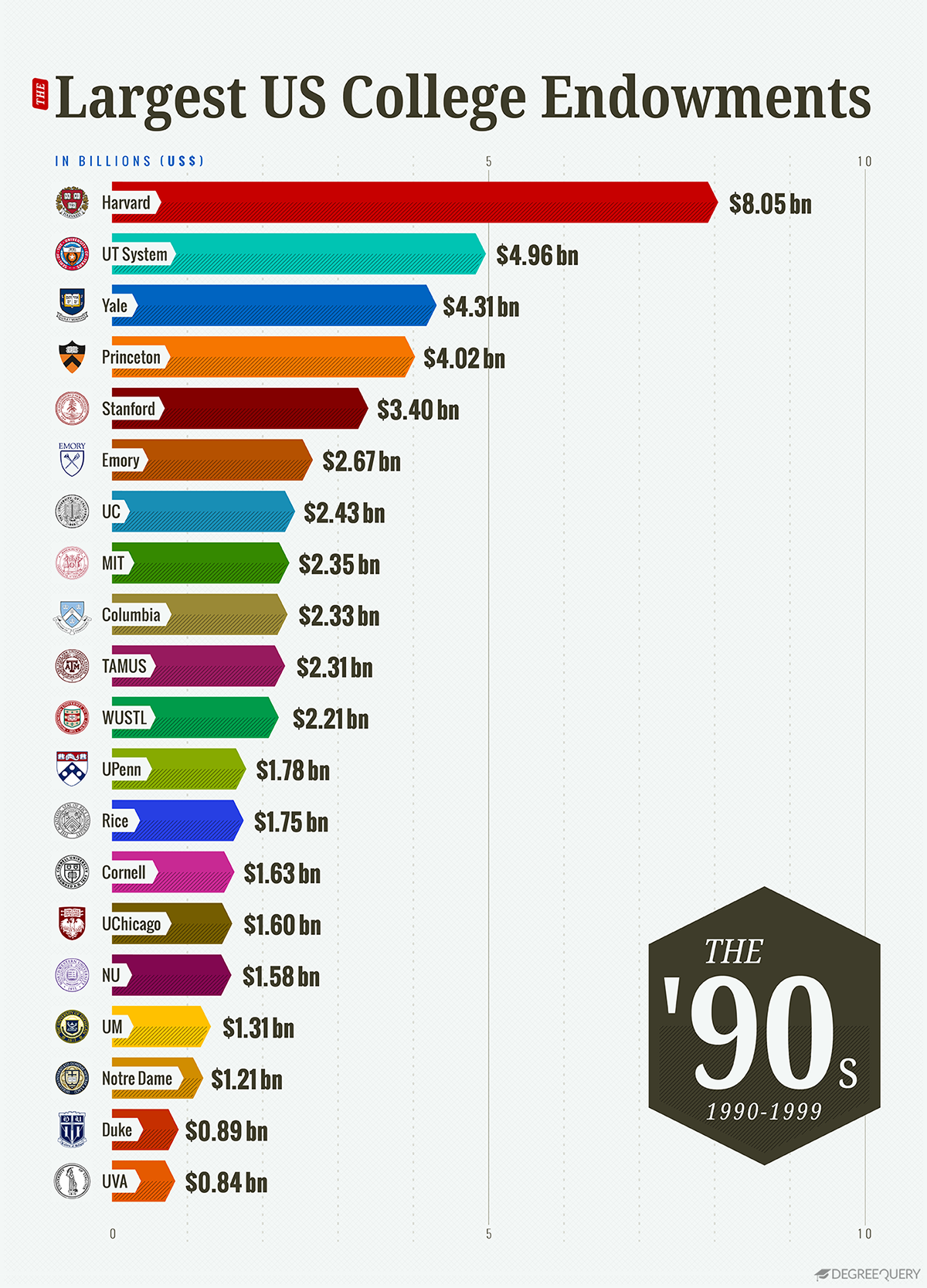

1. U.S. college endowments in the 1990s

From 1990 to 1999, the market value of the 20 largest U.S. college endowments grew at an average annual rate of 12.5% — the fastest of the last three decades. As you can see from our graph, over this period, the University of Michigan endowment rose from the 20th largest to the 17th largest, and the University of Pennsylvania rose from the 16th largest to the 12th largest. Meanwhile, the Columbia University endowment fell from the sixth-largest to the 11th largest. Although the University of Texas System endowment had the slowest growth of the 20 largest endowments over this period, it remained the second-largest endowment overall.

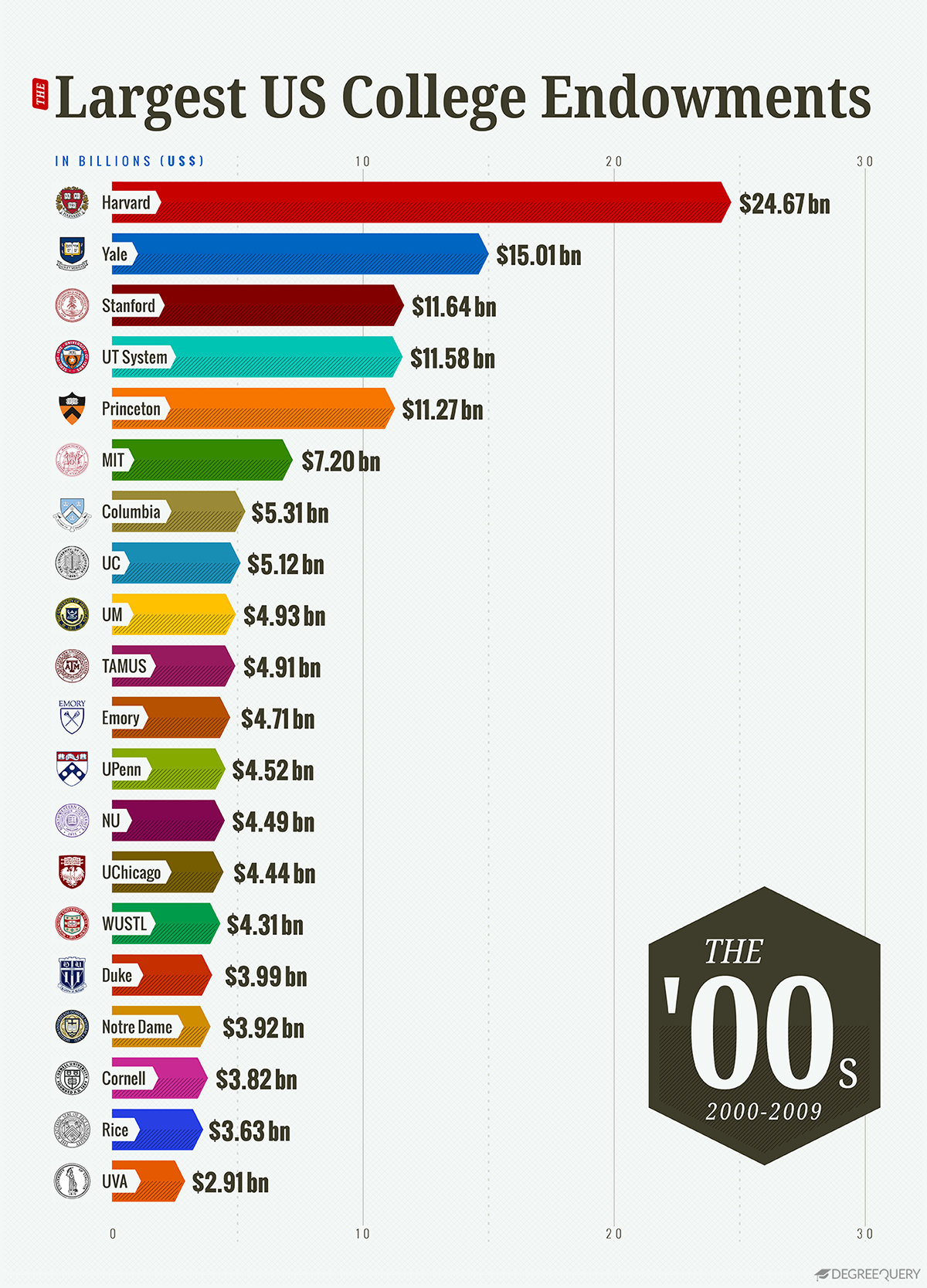

2. U.S. college endowments in the 2000s

Endowment growth is closely connected with the overall health of the economy. As of 2018, just 4% of endowment assets were held as cash, the rest invested in equities, fixed income instruments and alternative investment vehicles. In the lead up to the 2008 financial crisis — university endowments had increasingly invested in high-risk, illiquid investments like private equity, real estate and hedge funds. As a result, endowments lost tens of billions of dollars in value, with some schools losing more than 25% of their total endowment value. From 2008 to 2009, the total value of the 20 largest endowments fell 3.4%. Yale posted the largest percentage decline, losing 28.6% of its market value. Other university endowments that posted big losses from the recession include Harvard, Duke and Stanford.

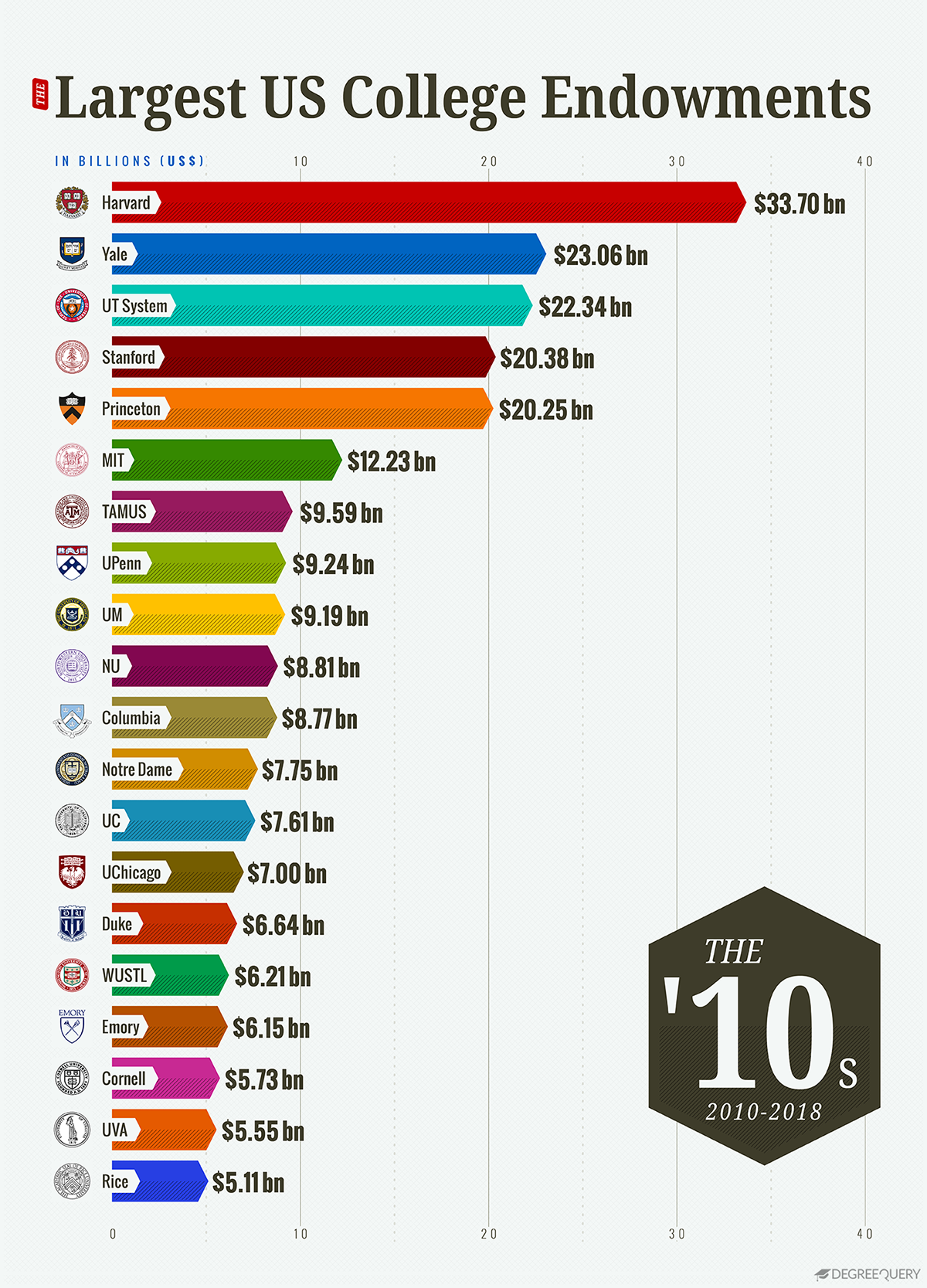

3. U.S. college endowments in the 2010s

Endowment growth rates rebounded in the wake of the Great Recession, although growth was still slow compared to the 1990s. From 2010 to 2018, the market value of the 20 largest endowments grew at an average annual rate of 7.6%. This is more than the 3.5% average annual growth rate for 2000 to 2009, yet less than the 12.5% rate for 1990 to 1999. During this period, the biggest winners were the University of Pennsylvania, rising from 11th to 7th largest, and the Texas A&M University System, which rose from 10th to 8th largest. Lackluster performance at some of the wealthiest schools has prompted some universities to make major changes to their endowment management. In 2017, for example, Harvard announced it would lay off roughly half of its 230-person staff in the wake of poor investment performance.

As you can see, university endowments were big business over the past 30 years. Nowadays, students, policymakers and the general public are increasingly involved in the conversation surrounding their management, mission and societal impact. For example, the 2017 Tax Cuts and Jobs Act, which imposed a 1.4% tax on the net investment income of the wealthiest endowments, recently sparked a wave of criticism from university administrators. Elsewhere on campus, protesting students demanded their universities divest from fossil fuel companies.

As the debate rages on and endowments continue to grow, these visualizations help us see how we got to this point.

Methodology

To get a better idea of how college endowments have changed over the last 30 years, DegreeQuery looked at the market value of the 20 largest U.S. college endowments from 1990 to 2018. Data on endowment asset value by university came from the National Association of College and University Business Officers (NACUBO) and is unadjusted for inflation. In years when certain universities did not participate in the NACUBO survey, we estimated the endowment value based on the compound annual growth rate for all available years. Estimated figures include the market value of the endowment assets for the Texas A&M University System for 1990, as well as the market value of the endowment assets for the University of California system for the years 1990 through 1992.

SOURCES

Fortune 500. (n.d.) Fortune 500 2018. fortune.com

NACUBO. (2019). Detailed Asset Allocations for U.S. College and University Endowments and Affiliated Foundations, FY18. nacubo.org

Miller, C. & Fabrikant, G. (2008). Universities retrench as endowments suffer from financial crisis. nytimes.com

Humphreys, J. et al. (2010). Educational Endowments and the Financial Crisis: Social Costs and Systemic Risks in the Shadow Banking System. tellus.org

Plender, J. (2014). There is a history lesson to be learnt from Yale endowment. ft.com

Fabrikant, G. (2017). Harvard Makes Changes in Managing a Lagging Endowment. nytimes.com

Tax Policy Center. (n.d.). What is the tax treatment of college and university endowments? taxpolicycenter.org

Townhomes are common in cities and densely populated neighborhoods. Townhouses are tall and narrow homes designed to make the most out of vertical space without too much of a yard or garden area.

Homes are considered townhouses when they:

- Share one or two walls with adjacent homes

- Have their own entrances

- Are built with multiple floors to maximize vertical space

- Often share a similar style to their neighbors’ homes and may operate under an HOA

Townhouses can be built to mimic other architecture styles, like Italianate and Greek Revival, while maintaining the condensed, vertical floor plan.

There was a renewed interest in handcrafted art and design following the industrial revolution. This became the “Arts and Crafts” era and paved the way for the Craftsman home, or “arts and crafts” home.

Craftsman homes focus on simplicity to counter the ornate stylings of Victorian homes. They’re also designed to highlight the craftsmanship of its builders and include:

- A low-pitched roof with overhanging eaves

- A covered porch

- Woodwork including exposed beams and built-in features like shelving

- Natural tones to complement the warmth from woodworking

Craftsman homes are favored for their character and are another versatile style that may borrow common elements from other home styles.

Second Empire homes were a modern Victorian-era style that started in France before spreading through the Northeastern and Midwestern United States. Second Empire architecture features similar ornate Victorian trends, though generally offers a simplified Victorian aesthetic.

These elements help identify a Second Empire home:

- Uniquely shaped Mansard Roof

- Decorative window framing and dormers

- Decorative rails or balustrades around terraces and staircases

- Iron roof crest and eaves with support brackets

Second Empire homes are also easy to identify since they’re the only Victorian-era style that often features a symmetrical, rectangular floor plan.

Italianate architecture continues the trend of asymmetrical design, romanticism, and Medieval influence — this time borrowing features from Medieval Italy. Italianate style is common up and down the East Coast and peaked in popularity between 1850 and 1880.

Italianate architecture features:

- Belvederes for natural light and airflow

- Overhanging eaves with decorative support brackets

- Tall and narrow or pedimented windows with rounded crowns

- Cast iron detailing and decor

Pattern books were becoming a popular way for craftsmen to build homes in different styles. This flexibility meant Italianate features were accessible for a variety of homes including large estates and urban townhouses.

Prairie-style homes were made famous by the architect Frank Lloyd Wright. These homes celebrate and complement the natural beauty of the Midwestern landscape with low and long shapes in the floor plan and building elements.

Prairie-style houses showcase:

- Long and low-to-the-ground builds

- Flat or shallow roofs with overhanging eaves

- Thin bricks or stucco exteriors to match the house shape

- Minimalist yet stylized ornamentation

Prairie houses inspired the flat planes and natural elements popular in Mid-century houses.

The American Farmhouse is a simple and timeless style. Farmhouses are designed to be practical first and foremost. They’re common across the US and often showcase regional variations, like wrap-around porches in the South.

Farmhouses have evolved with time and location, but often feature these elements:

- Rectangular floor plan

- Large front porches

- Natural wood and stone materials

- Few and small windows

- Formal front rooms separated from family rooms

Of course, the easiest way to identify a farmhouse is that they’ll often be situated on a large plot of farmland.