A college endowment refers to all the money that an institution receives in donations. However, endowment funds are not ‘no-questions-asked’ cash boosts for the college. Instead, endowments are tightly controlled investments that are supposed to be grown so that the interest can be used to upgrade facilities, hire new staff, provide scholarships or aid the college or its students in some way.

Over the past three decades, the total market value of the 20 largest college endowments has grown nearly tenfold — from $30.6 billion to $302.1 billion. As the size of college endowments has increased, so too has the debate over their purpose, management and ethical obligations.

To get a better idea of how college endowments have changed over the last 30 years, DegreeQuery looked at the market value of the 20 largest U.S. college endowments from 1990 to 2020.

30 Years of U.S. college endowments

Based on the most recent NACUBO survey of 810 universities, the total market value of endowments in 2018 was $624.3 billion. 48.3% of that is held by just 20 colleges. But why the huge growth in market value over the past 30 years? It might be something to do with how much of the endowment the university chooses to spend on operations or the return rates of the endowment’s investment portfolio. Due to their often wealthy donor base and long-term investment horizons, the largest university endowments can invest in a diverse array of asset classes, and often grow faster than the economy as a whole.

From 1990 to 2020, the market value of the 20 largest college endowments grew at an average annual rate of 8.5% — faster than the 6.6% average annual growth rate for the Fortune 500 over the same period. The universities with the fastest growth over the past 30 years include the University of Michigan, Duke University and the University of Notre Dame. Meanwhile, the endowments with the slowest growth include Emory University, Rice University and Washington University in St. Louis.

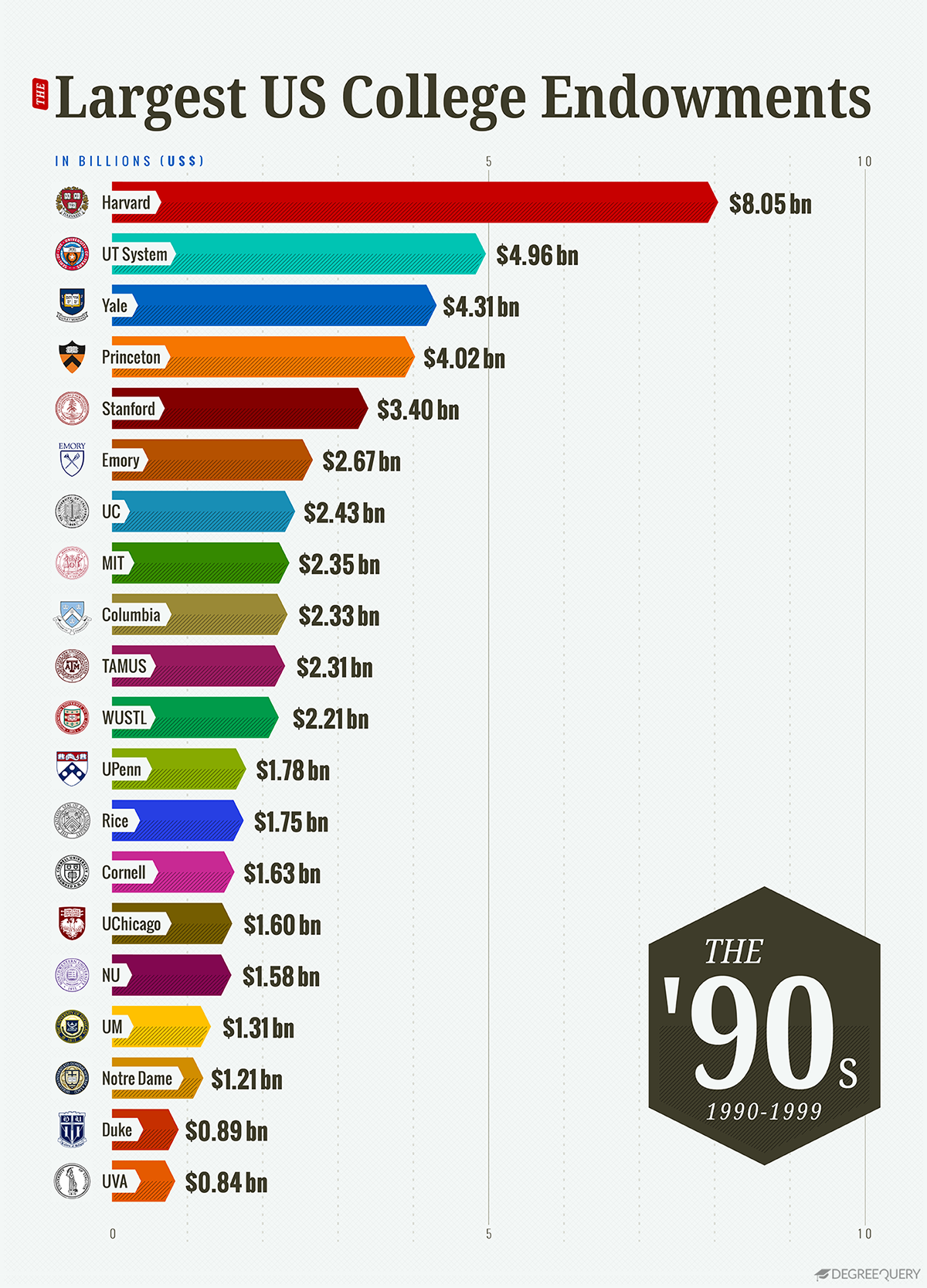

1. U.S. college endowments in the 1990s

From 1990 to 1999, the market value of the 20 largest U.S. college endowments grew at an average annual rate of 12.5% — the fastest of the last three decades. As you can see from our graph, over this period, the University of Michigan endowment rose from the 20th largest to the 17th largest, and the University of Pennsylvania rose from the 16th largest to the 12th largest. Meanwhile, the Columbia University endowment fell from the sixth-largest to the 11th largest. Although the University of Texas System endowment had the slowest growth of the 20 largest endowments over this period, it remained the second-largest endowment overall.

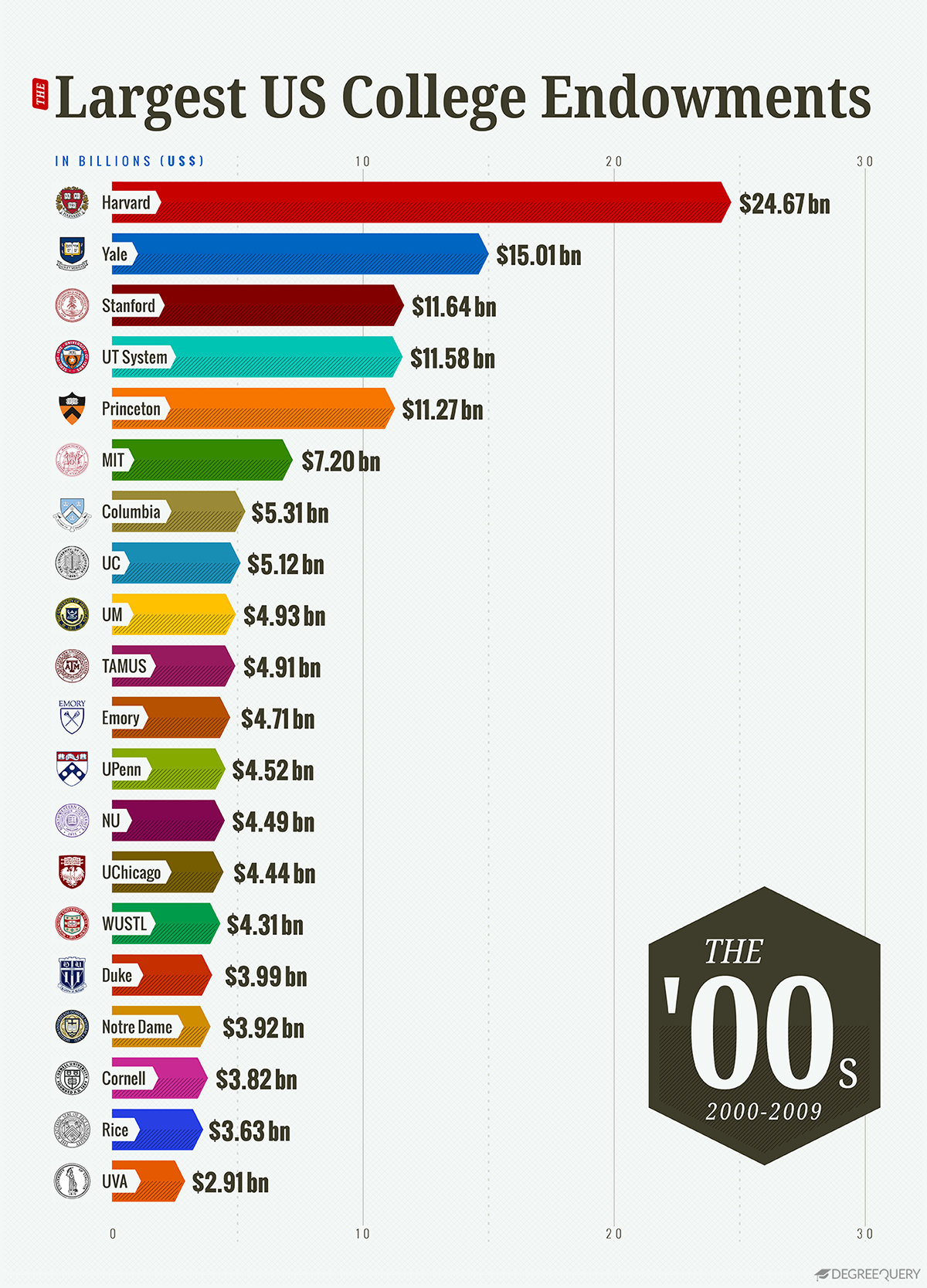

2. U.S. college endowments in the 2000s

Endowment growth is closely connected with the overall health of the economy. As of 2018, just 4% of endowment assets were held as cash, the rest invested in equities, fixed income instruments and alternative investment vehicles. In the lead up to the 2008 financial crisis — university endowments had increasingly invested in high-risk, illiquid investments like private equity, real estate and hedge funds. As a result, endowments lost tens of billions of dollars in value, with some schools losing more than 25% of their total endowment value. From 2008 to 2009, the total value of the 20 largest endowments fell 3.4%. Yale posted the largest percentage decline, losing 28.6% of its market value. Other university endowments that posted big losses from the recession include Harvard, Duke and Stanford.

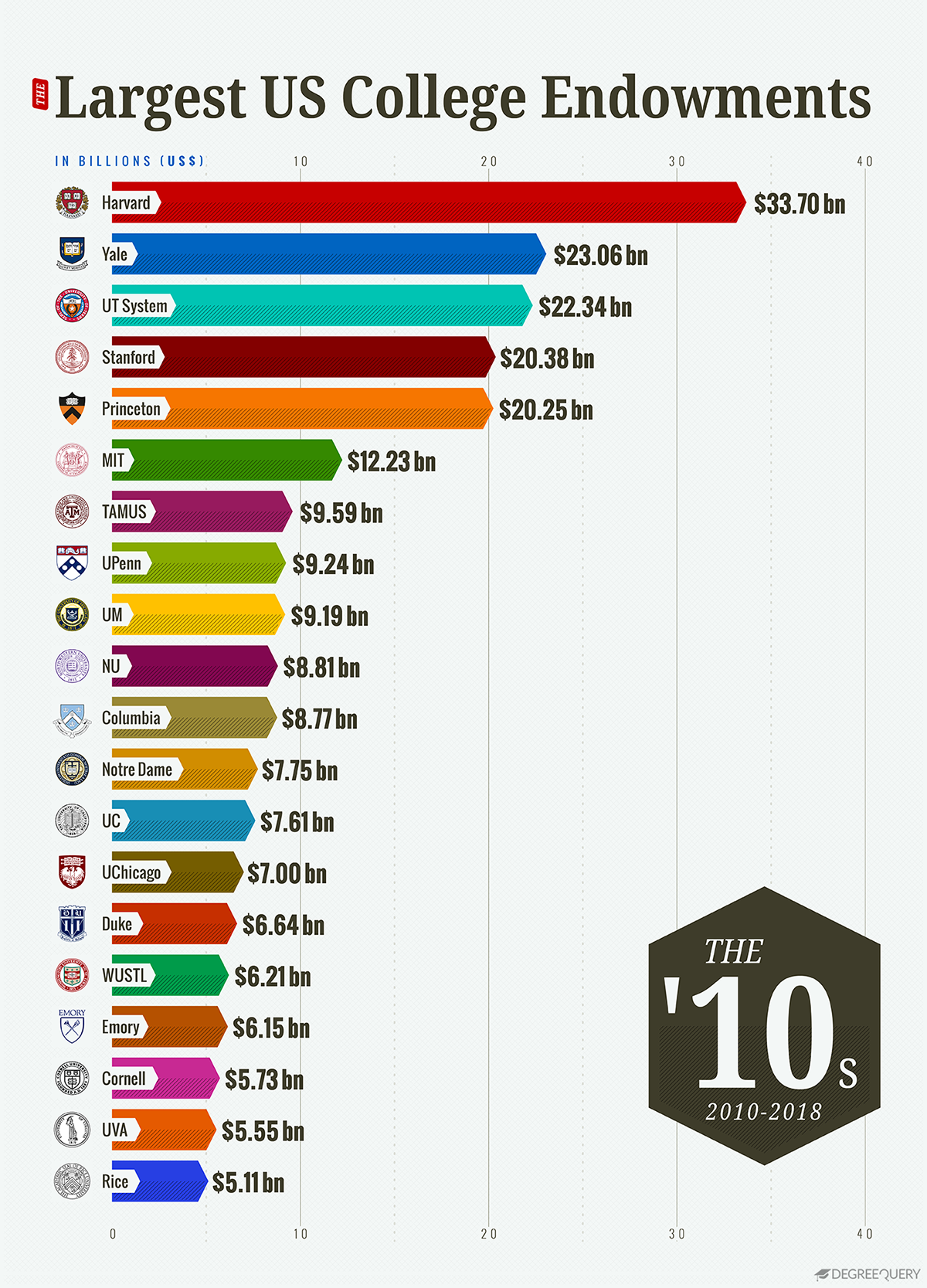

3. U.S. college endowments in the 2010s

Endowment growth rates rebounded in the wake of the Great Recession, although growth was still slow compared to the 1990s. From 2010 to 2018, the market value of the 20 largest endowments grew at an average annual rate of 7.6%. This is more than the 3.5% average annual growth rate for 2000 to 2009, yet less than the 12.5% rate for 1990 to 1999. During this period, the biggest winners were the University of Pennsylvania, rising from 11th to 7th largest, and the Texas A&M University System, which rose from 10th to 8th largest. Lackluster performance at some of the wealthiest schools has prompted some universities to make major changes to their endowment management. In 2017, for example, Harvard announced it would lay off roughly half of its 230-person staff in the wake of poor investment performance.

As you can see, university endowments were big business over the past 30 years. Nowadays, students, policymakers and the general public are increasingly involved in the conversation surrounding their management, mission and societal impact. For example, the 2017 Tax Cuts and Jobs Act, which imposed a 1.4% tax on the net investment income of the wealthiest endowments, recently sparked a wave of criticism from university administrators. Elsewhere on campus, protesting students demanded their universities divest from fossil fuel companies.

As the debate rages on and endowments continue to grow, these visualizations help us see how we got to this point.

Methodology

To get a better idea of how college endowments have changed over the last 30 years, DegreeQuery looked at the market value of the 20 largest U.S. college endowments from 1990 to 2018. Data on endowment asset value by university came from the National Association of College and University Business Officers (NACUBO) and is unadjusted for inflation. In years when certain universities did not participate in the NACUBO survey, we estimated the endowment value based on the compound annual growth rate for all available years. Estimated figures include the market value of the endowment assets for the Texas A&M University System for 1990, as well as the market value of the endowment assets for the University of California system for the years 1990 through 1992.

SOURCES

Fortune 500. (n.d.) Fortune 500 2018. fortune.com

NACUBO. (2019). Detailed Asset Allocations for U.S. College and University Endowments and Affiliated Foundations, FY18. nacubo.org

Miller, C. & Fabrikant, G. (2008). Universities retrench as endowments suffer from financial crisis. nytimes.com

Humphreys, J. et al. (2010). Educational Endowments and the Financial Crisis: Social Costs and Systemic Risks in the Shadow Banking System. tellus.org

Plender, J. (2014). There is a history lesson to be learnt from Yale endowment. ft.com

Fabrikant, G. (2017). Harvard Makes Changes in Managing a Lagging Endowment. nytimes.com

Tax Policy Center. (n.d.). What is the tax treatment of college and university endowments? taxpolicycenter.org

The French Colonial house style can be seen around the world and has significant variety among its sub-styles.

French Colonial houses have the same symmetry as other Colonial homes with these distinct features:

- Dormer windows, including one centered above the door

- External stairs to enter higher floors

- Iron stairs and balconies

- Slightly raised basements to support the floor

French Colonial houses are most similar to Spanish Colonial houses and easily identified by their elaborate iron balconies, stairs, and entrances.

Queen Anne homes were popularized in the later Victorian era, beginning around 1880. This style is the quintessential Victorian home for many, with ornate woodworking and decor inside and out.

Queen Anne homes have key regional differences across the country, but maintain these essentials:

- Textured walls with decorative shingles or half-timbering

- Large round or polygonal tower at the home’s corner

- Steeply pitched and asymmetrical roof

- Decorative spindles on porches and trim

- Decorative single-pane or stained glass windows

Queen Anne architecture is most common in homes, but can also be seen in schools, churches, and office buildings.

There was a renewed interest in handcrafted art and design following the industrial revolution. This became the “Arts and Crafts” era and paved the way for the Craftsman home, or “arts and crafts” home.

Craftsman homes focus on simplicity to counter the ornate stylings of Victorian homes. They’re also designed to highlight the craftsmanship of its builders and include:

- A low-pitched roof with overhanging eaves

- A covered porch

- Woodwork including exposed beams and built-in features like shelving

- Natural tones to complement the warmth from woodworking

Craftsman homes are favored for their character and are another versatile style that may borrow common elements from other home styles.

Gothic Revival architecture grew in the mid-19th century and was one of the early styles of Victorian-era homes. The Gothic Revival style takes influence from Medieval Europe and was designed as a country home. Architects believed the asymmetrical design and ornamentation complemented the nature of rural America.

Gothic Revival homes can be identified by their:

- Pointed arch in windows, doors, and decoration

- Elaborate wood trim vergeboards and bargeboards

- Steeply pitched roofs and front-facing gables

- Towers and turrets resembling medieval castles

Gothic Revival architecture was a popular style for schools and churches as well as rural homes.

Most Dutch Colonial homes you find today are actually from the Colonial Revival period of the early 20th Century. Original Dutch Colonial homes feature flared roof eaves and creative wood and brickwork. They are much more ornamental than classic Colonial homes, though the Dutch Colonial Revival style tends to be more subdued than the original Dutch Colonial homes.

Dutch Colonial Revival houses feature:

- Broad gambrel roofs that are visually similar to barn-style roofs

- Open-floor plans

- Flared roof eaves

- Split doors

The large barn-style roofs are the most identifiable feature of a Dutch Colonial home and even became known as “Dutch roofs.”

The U.S. health system is a mix of public and private, for-profit and nonprofit insurers and health care providers. The federal government provides funding for the national Medicare program for adults age 65 and older and some people with disabilities as well as for various programs for veterans and low-income people, including Medicaid and the Children’s Health Insurance Program. States manage and pay for aspects of local coverage and the safety net. Private insurance, the dominant form of coverage, is provided primarily by employers. The uninsured rate, 8.5 percent of the population, is down from 16 percent in 2010, the year that the landmark Affordable Care Act became law. Public and private insurers set their own benefit packages and cost-sharing structures, within federal and state regulations.