Deutsch-Chinesische Enzyklopädie, 德汉百科

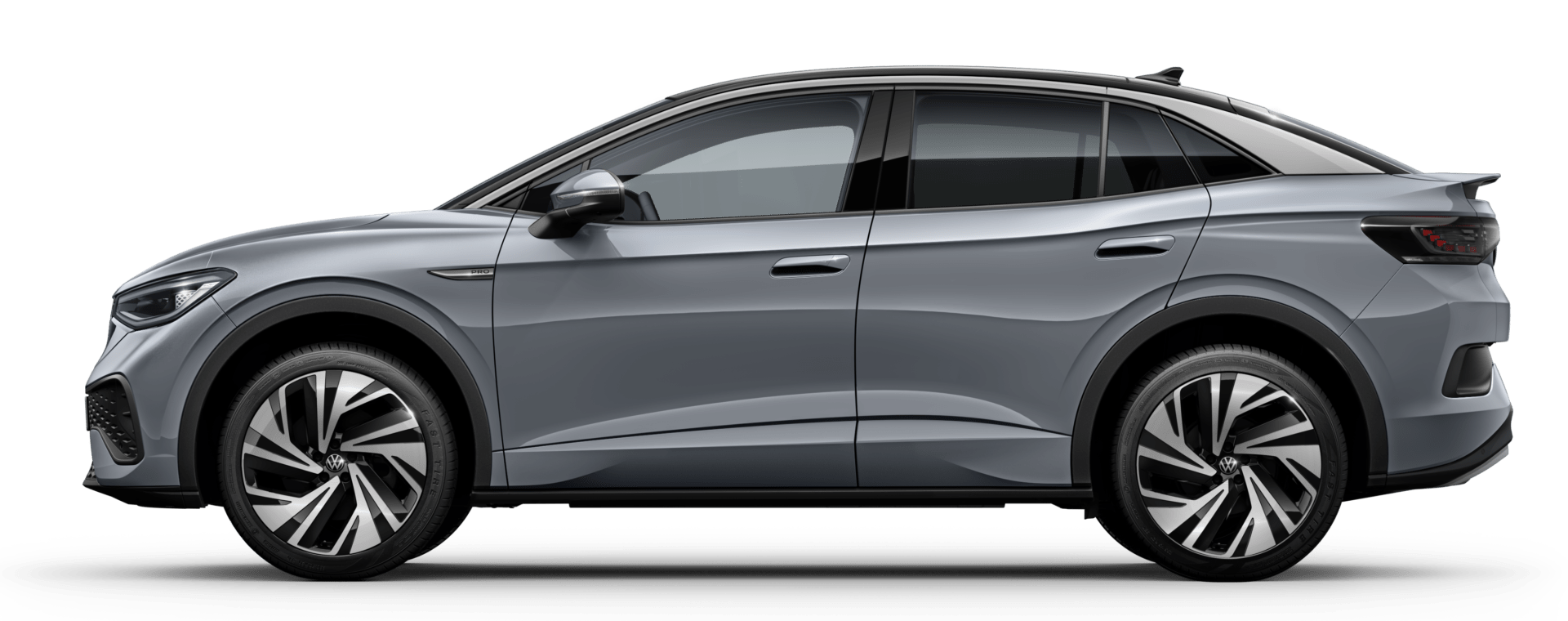

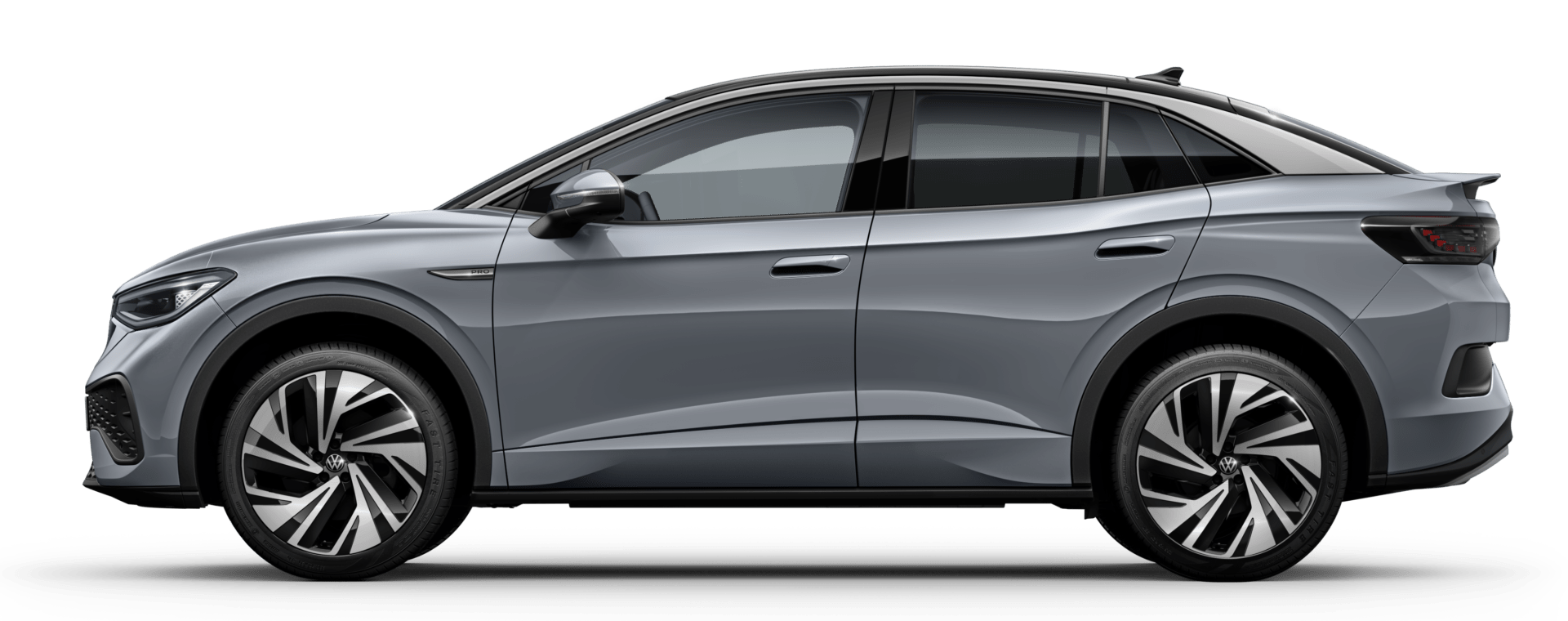

Automobile

Automobile

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Agriculture, forestry, livestock, fishing

Agriculture, forestry, livestock, fishing

Economy and trade

Economy and trade

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Disaster relief

Disaster relief

Useful info

Useful info

Useful info

Useful info

Financial

Financial

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Financial

Financial

Impact of Economic sanctions

Impact of Economic sanctions

Financial

Financial

*Italy economic data

*Italy economic data

Italy

Italy

Lazio

Lazio

Companies

Companies

Companies

Companies

*Centuries-old companies in the world

*Centuries-old companies in the world

Financial

Financial

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

巴塞尔协议(英语:Basel Accords),全名是资本充足协定(Capital Accord)[a],是巴塞尔银行监理委员会成员,为了维持资本市场稳定、减少国际银行间的不公平竞争、降低银行系统信用风险和市场风险,推出的资本充足比率要求。在1988年首次订立,并于2003年作出了第二次的修订。

Die Basler Vereinbarungen beziehen sich auf die vom Basler Ausschuss für Bankenaufsicht (BCBS) herausgegebenen Vereinbarungen zur Bankenaufsicht (Empfehlungen zur Bankenregulierung).

The Basel Accords[a] refer to the banking supervision accords (recommendations on banking regulations) issued by the Basel Committee on Banking Supervision (BCBS).[1]

Basel I was developed through deliberations among central bankers from major countries. In 1988, the Basel Committee published a set of minimum capital requirements for banks. This is also known as the 1988 Basel Accord, and was enforced by law in the Group of Ten (G-10) countries in 1992. A new set of rules known as Basel II was developed and published in 2004 to supersede the Basel I accords. Basel III was a set of enhancements to in response to the financial crisis of 2007–2008. It does not supersede either Basel I or II but focuses on reforms to the Basel II framework to address specific issues, including related to the risk of a bank run.

The Basel Accords have been integrated into the consolidated Basel Framework, which comprises all of the current and forthcoming standards of the Basel Committee on Banking Supervision.

Automobile

Automobile

Automobile

Automobile

*Electric car

*Electric car

Automobile

Automobile

*Electric car battery

*Electric car battery

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

Financial

Financial

*Brazil economic data

*Brazil economic data

Financial

Financial

*China economic data

*China economic data

Financial

Financial

*Germany economic data

*Germany economic data

Financial

Financial

*European Union economic data

*European Union economic data

Financial

Financial

*France economic data

*France economic data

Financial

Financial

*India economic data

*India economic data

Financial

Financial

*Indonesia economic data

*Indonesia economic data

Financial

Financial

*Italy economic data

*Italy economic data

Financial

Financial

*Japan economic data

*Japan economic data

Financial

Financial

*Canada economic data

*Canada economic data

Financial

Financial

*Russia economic data

*Russia economic data

Financial

Financial

*United States economic data

*United States economic data

Financial

Financial

*United Kingdom economic data

*United Kingdom economic data

Energy resource

Energy resource

IT-Times

IT-Times